For the Greater Good: Funding and Donation in Hard Times via the Crypto Ecosystem

Turkiye and Syria were hit by devastating earthquakes last week, with the loss of thousands of lives and homes. Disasters also illustrate new ways for financial technology to serve people.

At the time of writing, 41.000 people have lost their lives in a terrible disaster which has affected a large part of the Eastern Anatolian region. Dozens of countries immediately sent aid, in forms of both equipment and/or search and rescue teams in an impressive act of solidarity.

Turkiye also had lots of government agencies and NGOs to deploy help and offer assistance to those affected. The national agency, Disaster and Emergency Management Authority (AFAD) and the Turkish Red Crescent were at the forefront of government’s response and many NGOs such as AHBAP, various labor unions, miners and individual volunteers soon arrived at the scene.

The causes and aftermath of the earthquakes have been widely discussed and and I will not recount them all in this article. However, it must be noted that the damage caused by this catastrophe was not the result of a single thing/decision or completely unavoidable. Inadequate buildings with low standards, lack of supervision and amnesties throughout the history proved to be a ticking bomb that would explode sooner or later.

Can blockchain enable people to help faster?

Wave 1: Donations to Wallets

This is no way an exhaustive list of events or donations along with different organizations which provided insightful and useful routes to offer help but rather my own observations during these days.

This was one of the topics I wondered about back in 2018 in a blog post. We are familiar with funding methods such as Initial Coin Offerings (somewhat an equivalent of IPOs in DeFi), DAOs, crowdfunding methods and even witnessed huge amount of aid sent to Ukraine in cryptocurrencies, leading to swift regulations regarding their use. Apparently, these flows are still going strong, and in both directions.

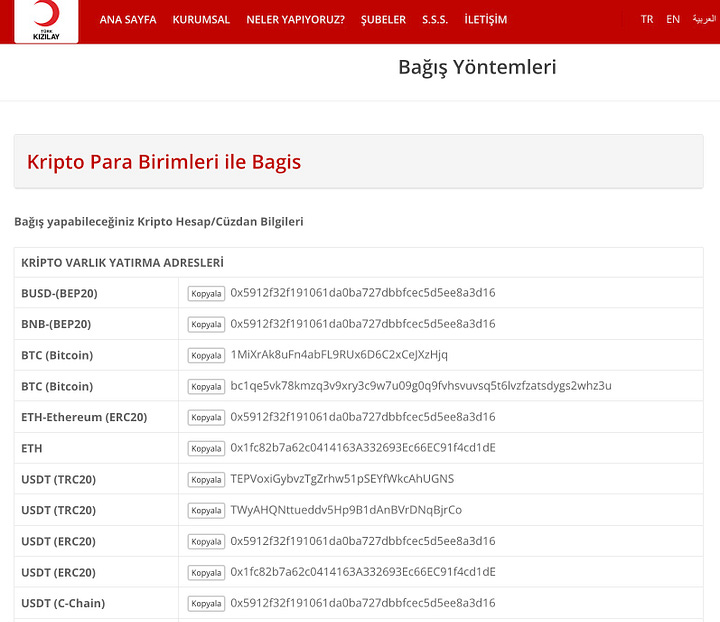

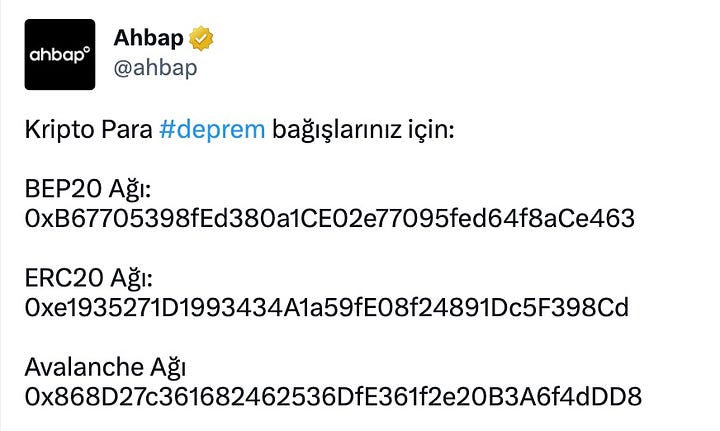

Turkiye did not have an exhaustive regulation on cryptocurrencies, except for a few such as the ban on cryptocurrencies as a payment method. The Financial Crimes Investigation Board (MASAK) swiftly (no pun intended) allowed institutions to collect donations via cryptocurrencies in an unanticipated manner. After wallet addresses were shared via Twitter accounts, AHBAP and the Turkish Red Crescent started to welcome various donations in different crypto assets. This is also a prime example of a bureaucratic process being sped up in times of need, proving its intrinsic potential to do so.

Lastly, many address were shared and a central point of organization was established with the help of Turkish CEX, i.e. BTCTurk. Currently the donation amount displayed on the website equals approximately 4 million USD which will soon be converted to TRY without any fees. According to Efe Bulduk, one of the signature owners of the multisig wallets, almost all donations are transferred to BTCTurk at this point (the rest will follow). However, I do not support the notion of “profit” here, as it was not a financial decision to do so and may have led to a loss if the markets performed differently. Nevertheless, the conversion process of assets with shallow markets and partial converting/transferring approach deserves praise along with the solidarity shown in the ecosystem. Given the turbulent markets, these huge volumes always have the potential to disrupt prices and the assets of the parties involved.

Those addresses saw lots of sincere donations like 1 million USD worth of AVAX from the Avalanche Foundation or a total of 99 ETH from Vitalik (which the test transaction of 1 ETH was funnily returned by someone to protest the amount) and Binance’s $100 worth of BNB airdrop to those residing in the area.

Wave 2: DAOs and Others

One of the major ones that saw an influx last week was Türkiye Relief DAO, and partly for wrong reasons, as some people tried to scam others by sharing different wallet addresses for donations, impersonating the original one. Nevertheless, many different websites and organizations were promptly online to address issues emerging in the area, such as providing physical goods to those in need.

There are probably many others I overlooked as I have not browsed this topic extensively, but I strongly believe the distributed approach can serve a lot of purpose here.

So what stands in the way?

Volatility

The main issues that always bugged my mind was the donations in unpopular coins/tokens. Aside from BTC, ETH and some stable coins, I was worried about the high, systemic volatility of the market and the volatility that may have ensued when these were converted to fiat. Fortunately, this scenario did not materialize and the markets are actually on the rise compared to the early days of last week.

But the question remain. Could anyone have guaranteed this would happen or will guarantee to happen again? Absolutely not.

The solution to minimize currency risk may be adopting stablecoins or coins like Bitcoin and Ethereum which have a high market cap if the conversion is expected to be carried out soon. Maybe, just maybe, a token designed to be used when disasters strike anywhere in the world to help those in need (just like IMF's SDR for monetary aid) stored in a decentralized network can shift the world towards a better place.

Certainly, the risks caused by use of volatile assets here can be hedged by positions, but this can be very laborious and probably very impractical in emergencies.

Decentralized…or not?

This brings the debate to another whole level. These assets must be converted into real goods and to do so, they must be converted to fiat. CEXs like BTCTurk forego their commission fees in doing so but when those amounts go off-chain, people just have to trust what they are told. I will probably write about this on my next piece.